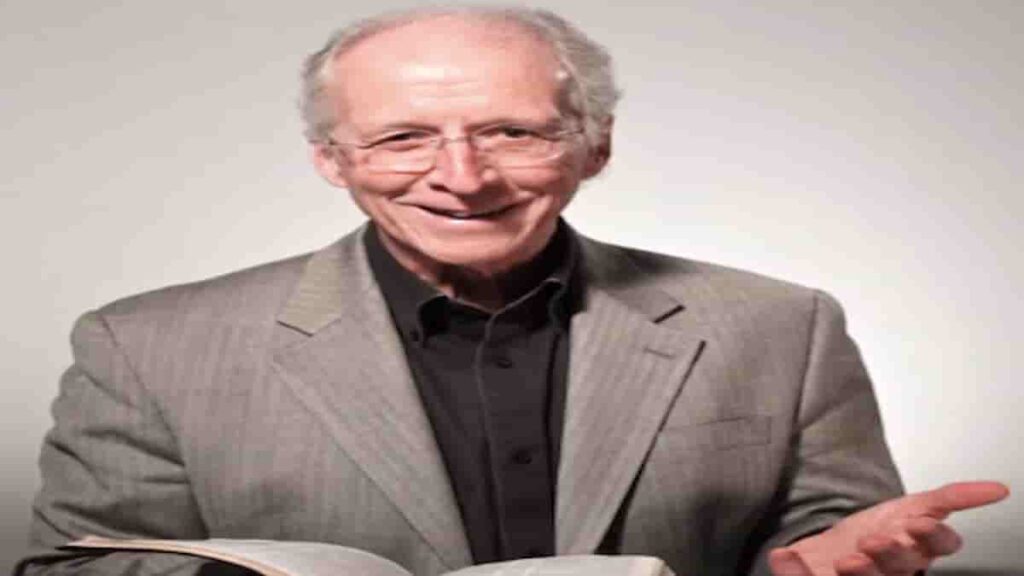

Daily Devotional By Desiringgod Ministry – John Piper Ministry 17 OCTOBER 2024 | Topic: How Much Money Do I Need to Retire?

Click HERE for Previous MESSAGES

How Much Money Do I Need to Retire?

How much money does an American need to retire? That question was in the air this spring after the Wall Street Journal featured a piece by Andrew Biggs titled “You Don’t Need to Be a Millionaire to Retire” (April 18, 2024). In part, he wrote that “according to a new survey from Northwestern Mutual, the average American thinks he’ll need $1.5 million in savings to be financially secure in old age. If that were true, it’d be bad news. As USA Today recently reported, the average U.S. adult has saved only $88,400 for retirement. . . . Among those with [between] $50,000 to $99,999 in savings — a small fraction of what retirees are told they need — 3% found it hard to get by, 11% were just getting by, and 86% were either doing okay or living comfortably.” A big disparity here in the numbers.

Obviously, on this podcast, we don’t get into specific numbers, Pastor John. But you have fielded a lot of questions about retirement, as can be seen in the APJ book on pages 429–439. In building out this theme comes this question from Linda, a podcast listener who is in her late fifties. She wants to know if you have any guiding thoughts on this question.

“Pastor John, hello. Can you share any wisdom for thinking about how much money I should be putting away for retirement? I’m trying to balance being responsible in providing for my future, while walking in faith, and giving generously towards mission, beyond my tithe. I’m a natural saver but also have a tendency towards hoarding money that can be easily provoked when I read that I need to have $1.5 million dollars saved or invested before I can retire. I’ll never reach that level. What would you say to an American in my situation, about seven years from retirement age?”

I think the first thing I would say is that I’m not a trained financial planner, and I am sure there are aspects of finance that I don’t know about and don’t understand, and that, therefore, to give any specific counsel, especially at a distance, would be foolhardy. And I would add how deeply thankful I am that I have trusted advisers around me in my life to help me with these things. I’m not talking just now that I’m an old man and I need some guidance for the last chapter of my life and how to do finances here. I’m talking about all my life.

I remember sitting at the dining-room table with a financial planner — a good friend from our church, but a trained financial planner. I had four small children, and I was asking him to help me think through my financial responsibilities to my wife and children if I die. We did that kind of thinking at every stage of our lives because that need, that financial need, changes with every stage of your life. And you try to think through at every stage, How can I be a good father, a good steward, a good caregiver when I’m gone for my wife and my children if they are bereft of the earning person in this family? So, I certainly would encourage that for others. We all seek help from Bible-saturated, wise people who know the ropes in these things.

“Christians lean toward needs, not comfort. We relieve suffering, especially eternal suffering.”

Then, besides my own limitations, we need to be reminded that there are so many variables in people’s lives that no one solution, no one pattern of handling finances applies the same to everybody. There are family variables and geographic variables and cost-of-living variables and housing-option variables in different cities and health variables. Oh my goodness, there are just so many factors that feed into our planning for how to handle what little or more finances we may have. Everyone’s situation is unique.

So, what should I say to Linda, who is in her late fifties and wants to maximize her giving to missions now, and yet knows that it is probably wise to set aside money for the season when she will not be earning like she is now? And even before I answer that question, I can’t help but say in passing that I am aware that thousands of our listeners from less-developed countries around the world can’t even dream of some of the questions we are posing here because the economic and social structures don’t even exist that allow for this kind of financial planning. But I hope that these precious listeners of ours from around the world will hear underneath what I’m about to say some biblical principles that might apply (I hope do apply) in their situation.

Self-Sustaining Principle

Perhaps the most basic principle about supporting ourselves during the last quarter of our lives is that, inasmuch as possible, we should seek by God’s grace to be self-sustaining. Consider these verses from 1 and 2 Thessalonians:

- 2 Thessalonians 3:7–8: “You yourselves know how you ought to imitate us, because we were not idle when we were with you, nor did we eat anyone’s bread without paying for it, but with toil and labor we worked night and day, that we might not be a burden to any of you.” So, that’s what Paul says they should imitate.

- 2 Thessalonians 3:12: “Now such persons we command and encourage in the Lord Jesus Christ to do their work quietly and to earn their own living” — or literally, “to eat their own bread.”

- 1 Thessalonians 4:10–12: “We urge you . . . to aspire to live quietly, and to mind your own affairs, and to work with your hands, as we instructed you, so that you may walk properly before outsiders and be dependent on no one.”

So, I draw out from those passages the principle that, insofar as we are able, we should earn our own living, pay our own way. And I think that applies from the day we start earning to the day we die. And since we know that we will not be able to continue in some jobs because of mandatory retirement ages that are imposed upon us, and we will be prevented from earning our own living sometimes because of weakening bodies, therefore, we should plan for how we will obey this principle in the last quarter of our lives — namely, to be financially self-supporting. That’s an essential part of the biblical rationale for all the financial instruments that exist for paying ahead for that season of life.

Caregiving Principle

But it is manifestly obvious that millions of people here and around the world will outlive their ability to be independent. And so, the New Testament has another principle — namely, the caregiving obligations of family and church and then (by implication, I think) the social safety net that the wider community may create. So, here’s 1 Timothy 5:16: “If any believing woman has relatives who are widows, let her care for them. Let the church not be burdened, so that it may care for those who are truly widows.” In other words, they don’t have anybody, they don’t have any family to care for them, and the church is going to step in. “If anyone does not provide for his relatives, and especially for members of his household, he has denied the faith and is worse than an unbeliever” (1 Timothy 5:8).

So, where we are no longer able to be self-providing, God has ordained that families and churches step in. And I suspect that the existence of legally mandatory social security in the wider society is owing to deeply rooted Christian influence that says we won’t throw away our old people but find a way to care for them. I think it’s possible to participate in that system. I’m in it, and still believe that the family and the church have special responsibilities. If you feel like that needs more defense, we can do that at another time.

Ministry Principle

Another biblical principle I would stress is that the Bible has no conception of what Americans typically think of as retirement — that is, working for forty or fifty years and then playing for fifteen or twenty years: fishing, golfing, shuffleboard, pickleball, yard work, travel, hobbies, bucket lists, as if heaven was supposed to begin at 65 rather than death.

This principle relates directly to Linda’s concern about money for missions now and how it relates to her post-earning years. And the way it relates is this: If God is gracious in granting basic health, then wise planning for the last quarter of your life would mean that you keep on giving to missions. It’s not like “I do it now or I don’t do it,” but rather, you keep on from your fixed income. You just keep right on giving to missions. It may not be as much, but you do. And it’s a glorious thing to be able to give at least a little bit if your income is small. You don’t stop giving.

And even more important is this: In that season, that last season of your life, you are on a mission. You’re not stopping life and starting heaven. You are on a mission. You don’t just give to missions; you become missions. You don’t think mainly play; you think mainly ministry. As long as you are able, you lean toward meeting needs. That’s what you do. That’s what Christians do. They lean toward needs, not comfort. Heaven is comfort. This world is racked with pain, suffering, calamity, and needs, and that’s what we do. We relieve suffering, especially eternal suffering. You stay zealous for good deeds right to the end. You magnify Jesus by serving. Heaven is coming. It’s not meant to drag forward. We’re not meant to drag it forward out of the future into the present. It’s meant to sustain hope and ministry.

Now, I know these principles are very general, but I think if Linda and all of us were to think in these ways about the last quarter of our lives, God in his mercy would give us all the guidance we need about the details of financial planning.

ALSO READ: CLICK HERE TO FOLLOW US ON TWITTER ⊗ OPEN HEAVEN ⊗ JOEL OSTEEN DEVOTIONAL⊗ ABOVE ONLY ⊗ OUR DAILY BREAD ⊗ SEEDS OF DESTINY ⊗ JOYCE MEYER DEVOTIONAL ⊗ RHAPSODY OF REALITIES ⊗ JOHN HAGEE ⊗ MFM DAILY DEVOTIONALUTMOST FOR HIS HIGHEST⊗DCLM DAILY MANNA ⊗ JOHN PIPER DEVOTIONAL ⊗